Sell Your Company and Safeguard the Legacy You Spent Years Building.

We acquire profitable service businesses in the UK and Singapore.

Focused on health, education, and essential services — we help retiring founders exit smoothly and confidently.

You built something that matters - now let’s structure a win-win exit that respects your people, culture, and balance sheet.

You’ve served your clients, grown your team, and made a difference.

- But now you’re wondering…

→ Is there life beyond 60-hour weeks—without a succession plan in place?

→ What is your business really worth—without the runaround from brokers?

→ Is it possible to find a buyer who will honor your staff, your clients, and your mission?

Trust-First

Approach

Confidential, no-obligation discussions

Flexible Deal

Engineering

Mix of cash, earn-out, or minority roll-over

People-Centric

Transition

We protect jobs

and culture

Flawless

Close

Dedicated deal team drives due-diligence to funding

Our Mission

To craft founder-friendly exits that preserve legacy and unlock wealth

Our Vision

A world where every owner can step back with pride, knowing their life’s work—people included—will thrive for decades.

About ExitPath Ventures

We’re a team of experienced business owners and entrepreneurs who have walked your path.

At ExitPath Ventures, we understand the challenges of owning and operating a business — and, more importantly, the complexities involved in transitioning from a Founder to a new owner or preparing for retirement.

With over two decades of experience working closely with business owners and founders across various industries, we’re here to guide you through this critical phase with confidence and care.

We operate in key English-speaking markets, including UK European Union, North America, and Singapore—providing global insight with a personal, hands-on approach.

125

Founders advised on exit readiness

$41M

Total EBITDA reviewed

18

Active deals in pipeline

240+

Vetted micro-PE & family-office investors

48-hour

Average turnaround for confidential exit assessments

About Our Founder

Led by Anna C. Mallon, a global entrepreneur, investor, and advisor who has built and exited multiple businesses - ExitPath Ventures specialises in acquiring profitable, purpose-led companies.

Anna brings over 25 years of experience across Europe, Asia, and the US, having supported 2000+ founders, facilitated over $500M in funding, and worked with global names such as AWS, Techstars, and Founders Institute. Her track record includes building innovation ecosystems, structuring high-value exits, and helping founders transition smoothly into their next chapter.

Known for combining empathy, execution, and integrity, Anna ensures deals work for all stakeholders - retaining teams, protecting culture, and preserving the seller’s legacy.

Recently helped a 62-year-old training-services founder in the UK secure a 4.2× EBITDA sale with staff retained—while he moved to part-time advisory in 90 days.

Check Anna's LinkedIn account to know her more

Anna has worked with and her insights featured with

Team & Advisors

Anna C. Mallon

Founder & CEO

Global entrepreneur and investor with 25+ years of experience building, scaling, and exiting multiple ventures across Europe, Asia, and North America.

Christian Behn

Finance Expert, Advisor

Founder & CEO of Finipsis, Christian delivers valuation modelling and due diligence support for acquisitions.

Tony Hedger

Finance & Funding Specialist

36 years in banking and as an independent finance expert, Tony structures tailored funding solutions to support clean, scalable acquisitions.

Peter Goldstein

Capital Markets & IPO Advisor

An entrepreneur and former investment banker with 30+ years in capital markets, Peter has led IPOs, uplistings, and reverse mergers.

Simon Misiewicz

Tax & Structuring Advisor (UK)

A Chartered Certified Accountant, Simon advises on cross-border tax planning and succession strategies, specializing in clients with international holdings.

Ani Chen

Tax & Structuring Advisor (SG)

Strategic tax planning and structuring expertise for cross-border deals across Asia, ensuring compliance and efficiency in complex markets.

Aimee Batislaon

Project Manager

Aimee coordinates cross-functional projects, ensuring timelines and deliverables are met for acquisitions and investor initiatives.

Joanne dela Cruz

Compliance Coordinator

Joanne oversees compliance and governance processes, safeguarding each deal’s integrity.

Typically we acquire with revenues

of between $1M to $20M.

We seek businesses that…

-

Are financially strong – $1M–$20M annual revenue and $300K–$1mill EBITDA.

-

Serve enduring, human-led markets – in sectors such as education & advisory, health & wellness, property & home services, senior care, legacy & productivity services (e.g. VA agencies, estate planning), tech platforms with human delivery, and other recession-resilient industries.

-

Have loyal customers and stable teams – with operations that don’t rely on the owner’s daily involvement.

We don’t pursue:

-

VC-backed “hyper-growth” ventures chasing the next funding round.

-

Distressed businesses in need of a turnaround.

Process

Step 1: Share Your Numbers Confidentially

Secure upload, 3-minute form.

Step 2: Founder Discovery Call

Clarify goals, timeline, deal preferences.

Step 3: Receive Your Bespoke Offer

Clear terms; you choose pace & role after close.

Contact Us Today

Ready to Explore Your Exit?

Whether you’re actively looking to sell or simply wondering what’s possible - we’d love to hear your story.

Not yet ready for a call?

Find out what your business is worth — take our FREE scorecard and get your results in minutes.

Take the quiz now!

"I started ExitPath because I’ve seen too many amazing founders burn out, walk away with too little, or give their business to the wrong buyer.

If you’re even thinking about stepping back - I invite you to have a conversation. No pressure. No BS. Just possibilities.”

Anna C. Mallon, Founder, ExitPath Ventures

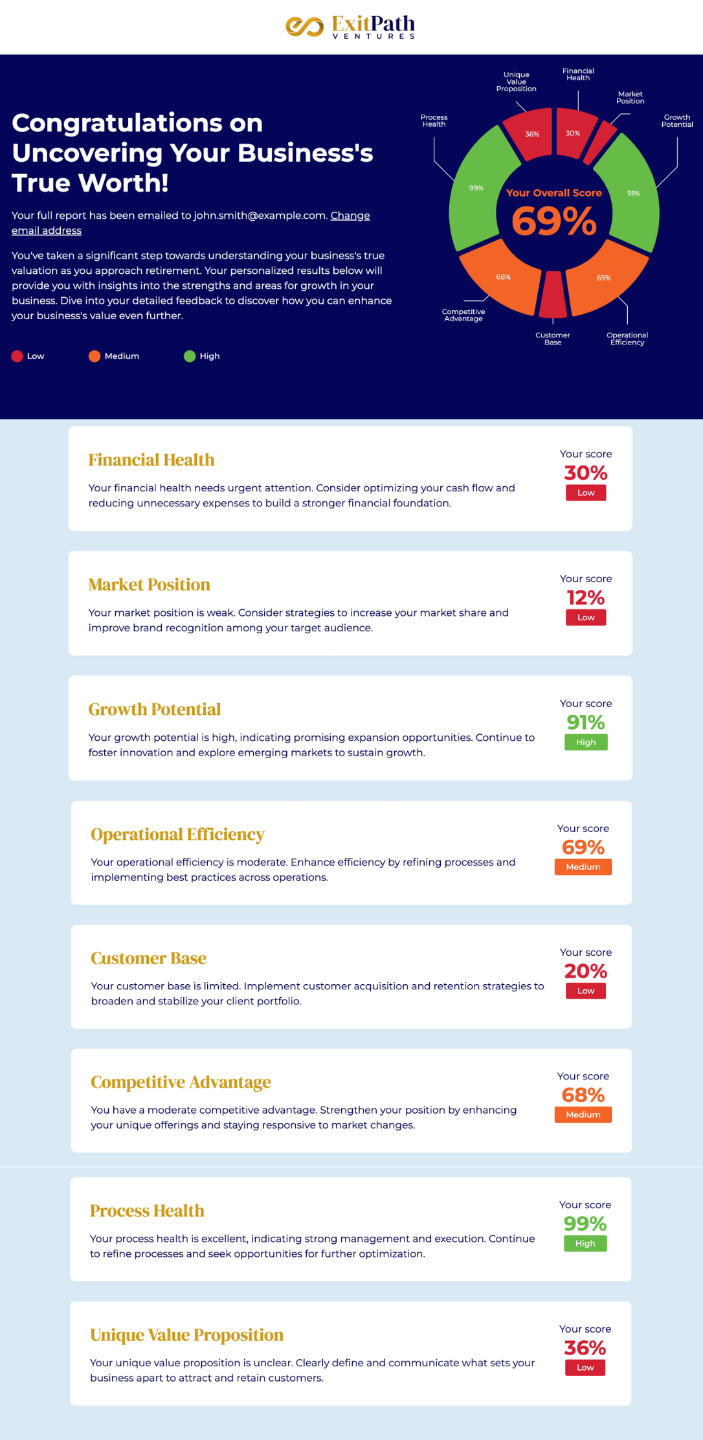

Discover What Your Business Is Really Worth — in Minutes

Take our FREE Business Value Assessment and get a clear, tailored snapshot of:

-

What your business could be worth today

- The key drivers increasing (or holding back) your valuation

- Practical next steps to boost your exit outcome

In just 5 minutes, you’ll have results you can use to plan smarter, negotiate stronger, and move closer to the freedom you’ve worked for.

👉 Start your free assessment now and get instant results.

ExitPath Ventures

exitpath@annacmallon.com

anna@annacmallon.com

Singapore - Amsterdam - London